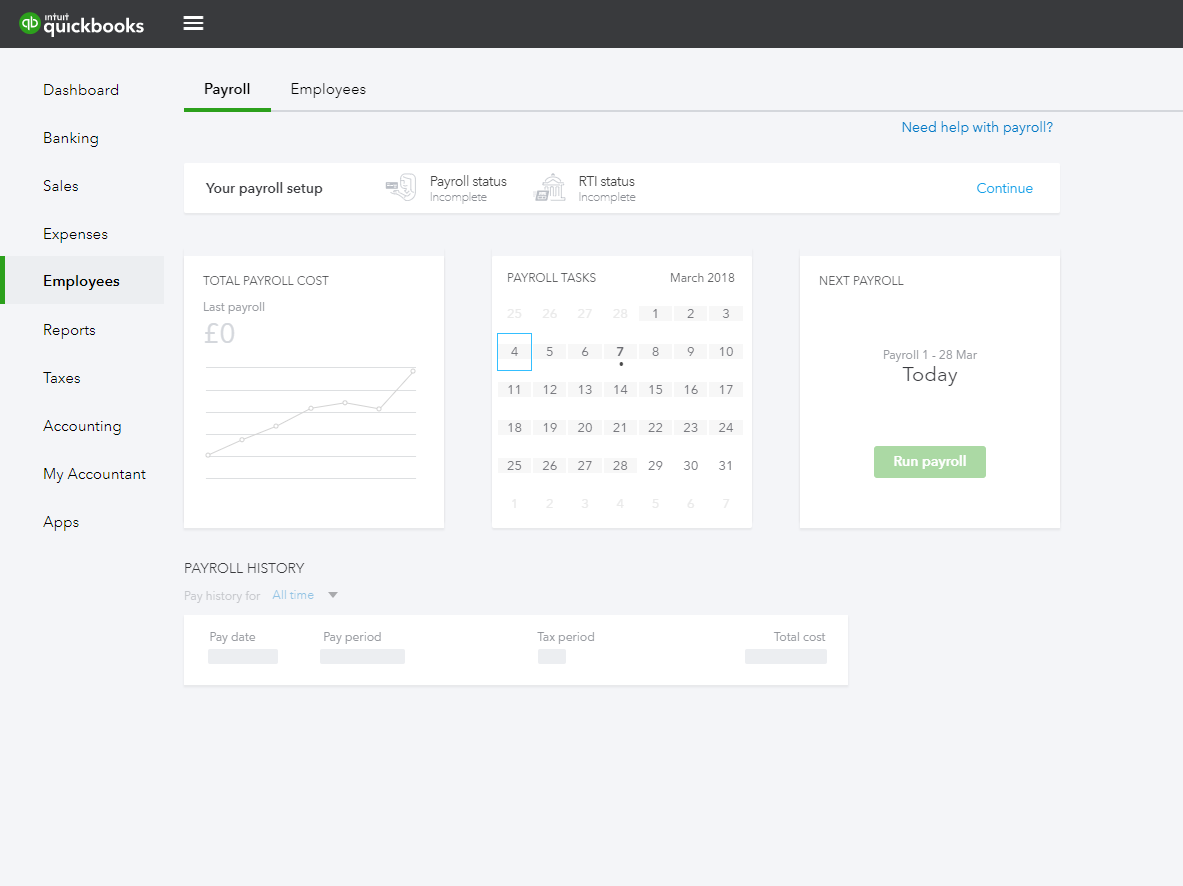

If you have not made the company payroll then set it up for the direct deposit. In QuickBooks Online Payroll, one has to connect a company bank account so that the direct deposit can be used. Here, you are supposed to pursue the on-screen prompts until you view the “Confirmation” screen.Once done, press the “Continue” button.After this, add the “Direct Deposit PIN” in the required field.Here, you can click on the “Direct Deposit” option.

To select the vendor name, make sure you click twice on the vendor’s name.

All you have to do is choose the vendor and enter the details correctly. If you are using QuickBooks Desktop Basic, Standard, or Enhanced version, you can create the direct deposit for your vendor. QuickBooks Desktop Payroll Standard, Basic, and Enhanced

#Manage payroll intuit percentage direct deposit how to#

Let’s read more about how to set up direct deposit for vendors in QuickBooks Desktop and Online. In the following guide, we will cover a number of QuickBooks variants such as QuickBooksDesktop Payroll Basic, Enhanced, Basic, Payroll Assisted, and QuickBooks Online Payroll. Entering the wrong details may get your direct deposit canceled.īe it QuickBooks Online or Desktop, you can enter the vendor details. If you are planning to set up direct deposit for vendors then make sure that you enter the correct details of a specific vendor. Users should note that, in order to meet the requirements of Federal and State compliance across all the offerings, Intuit’s Direct Deposit cannot be used to make payments to those who are not independent contractors. How to Set Up Vendor Direct Deposit in QuickBooks? QuickBooks Desktop Payroll Standard, Basic, and Enhanced.How to Set Up Vendor Direct Deposit in QuickBooks?.

0 kommentar(er)

0 kommentar(er)